Insurance for Digital Nomads: Essential Coverage for a Flexible Lifestyle

The rise of remote work and digital nomadism has created a demand for unique insurance products that cater to these on-the-go professionals. Digital nomads typically move from country to country while working, which means they require insurance that offers coverage for medical, travel, and sometimes even gear protection, across multiple destinations.

As a result, several insurance companies have stepped in to offer tailored plans explicitly designed for digital nomads. These policies take into account the specific needs and challenges faced by these travelers, such as ensuring comprehensive health coverage while abroad, lost or damaged equipment, and potential trip disruptions.

Navigating the world of digital nomad insurance can be overwhelming, but understanding the various options available and their benefits will help remote workers choose the best plan for their unique lifestyle. By evaluating factors like coverage, cost, and reliability, digital nomads can find insurance that provides peace of mind as they continue their global journey.

- Understanding Insurance for Digital Nomads

- Top Digital Nomad Insurance Providers

- Coverage Options and Benefits

- Pricing and Flexibility

- Dealing with Pre-existing Conditions and Exclusions

- Coverage for Remote Workers and Long-Term Travelers

- Choosing the Best Insurance for Your Needs

- Frequently Asked Questions

Understanding Insurance for Digital Nomads

Insurance for digital nomads is an essential aspect of a successful remote working lifestyle. As digital nomads travel and work abroad, they require specialized insurance policies that cater to their unique needs and situations. These policies often include coverage for health, travel, and even equipment protection.

Digital nomad travel insurance focuses on providing coverage for unforeseen events while they explore the world. This type of insurance typically covers trip cancellations, lost luggage, medical emergencies, and possibly even adventure activities that might not be included in standard travel insurance policies. Some popular travel insurance providers for digital nomads are World Nomads and SafetyWing.

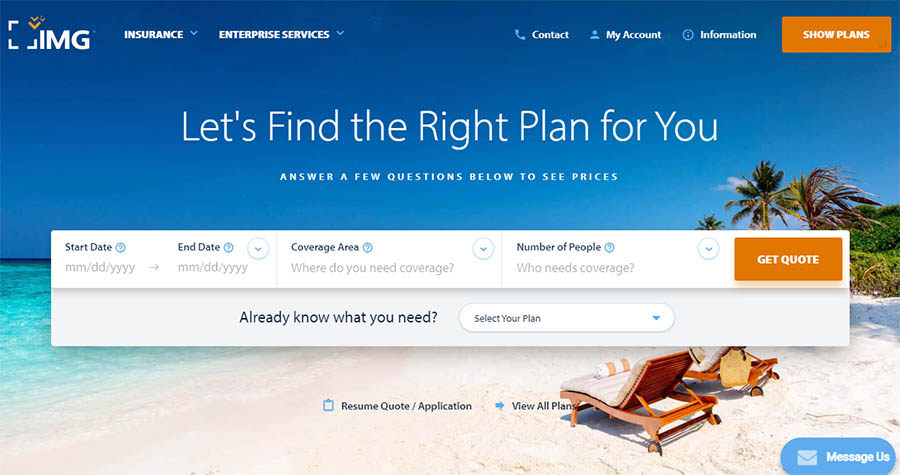

Digital nomad health insurance, on the other hand, goes beyond common travel insurance coverage, offering long-term healthcare options suitable for remote workers living and traveling overseas. These policies extend protection to include visits to medical professionals, prescription medications, and may even cover pre-existing conditions. Top choices for health insurance plans for digital nomads include IMG Global and PassportCard Nomads.

Lastly, digital nomad insurance can encompass policies that protect the tools and equipment crucial to a nomad's work. Many remote workers carry expensive laptops, cameras, and other electronic devices that need protection against theft or damage. It's essential for digital nomads to ensure their insurance policies offer adequate coverage for their valuable gear, as some providers may have limits on the maximum value covered.

In summary, digital nomads must prioritize finding insurance policies tailored to their lifestyle and work requirements. This involves carefully considering various factors like the extent of travel, the countries they plan to visit, their healthcare needs, and the value of their equipment. By thoroughly evaluating their options, digital nomads can secure peace of mind and focus on their adventures and work projects.

Top Digital Nomad Insurance Providers

World Nomads

World Nomads is a popular choice for digital nomads due to their comprehensive coverage and flexible plans. They offer a variety of insurance options tailored for different types of travelers, including digital nomads. Coverage includes emergency medical and dental, trip cancellation, baggage loss, and more. World Nomads is widely known for their excellent customer support and their ability to cater to various adventure activities.

SafetyWing

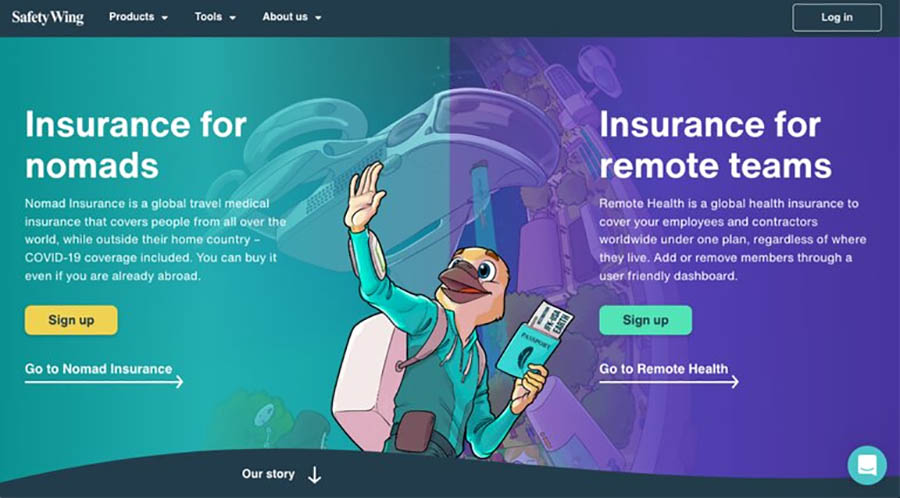

SafetyWing is specifically designed for digital nomads and remote workers. It is an affordable and robust option, priced at $42 per month for comprehensive medical insurance. Their monthly subscription model makes it easy for nomads to maintain coverage as they travel. With SafetyWing, customers receive primary health insurance, and can purchase coverage even when already abroad. It is rapidly growing in popularity among the digital nomad community.

Insured Nomads

Insured Nomads is an international insurance provider that understands the unique needs of digital nomads. They offer a variety of coverage options, from travel insurance to comprehensive health and wellness plans. With a strong focus on customer support and a digital-first approach, Insured Nomads are a reliable choice for those seeking a tailored insurance solution while living and working remotely.

Genki

Genki is a travel health insurance designed specifically for digital nomads. Recognizing that health is a top priority wherever you travel, Genki offers a range of benefits with a flexible monthly subscription that you can cancel anytime.

The insurance covers risks associated with various age groups,up to 69, and you have the freedom to choose any authorized healthcare provider. The subscription renews monthly and guarantees the price for up to 2 years. Whether you encounter a scooter crash in Thailand, dengue fever in Bali, or a surfing accident in South Africa, Genki is there to support you. The claim process is straightforward: visit a doctor, send the claim form, and get paid within a month. For hospital stays, the hospital calls the hotline, and Genki pays the hospital directly.

IMG Global

IMG Global is known for its diverse range of insurance solutions, designed for international travelers and expats, including digital nomads. They offer short-term travel insurance as well as long-term, full coverage health insurance plans. IMG Global also provides a wide range of additional benefits, such as trip interruption, baggage loss, and emergency medical evacuation. With an extensive network of healthcare providers and excellent customer service, IMG Global is an excellent option for digital nomads seeking comprehensive healthcare coverage.

Coverage Options and Benefits

Healthcare and Medical Expenses

Digital nomad insurance often includes healthcare and medical coverage, which is crucial when working and living abroad. Insurance plans can cover medical expenses such as doctor visits, hospital stays, surgeries, and even emergency dental work. Some plans also offer coverage for maternity, vision care, and wellness check-ups. Remember to review coverage limits and deductibles to ensure the insurance adequately meets your needs.

Trip Cancellation and Interruption

Trip cancellation and trip interruption insurance help protect digital nomads from financial losses due to unforeseen circumstances. This coverage offers reimbursement for non-refundable pre-paid expenses when a trip gets unexpectedly canceled or interrupted. Common reasons include family emergencies, weather, lost visa/travel documents, and even political unrest.

Baggage and Personal Belongings

Insurance plans for digital nomads usually come with baggage and personal belongings coverage. This means reimbursement for lost, damaged, or stolen luggage and personal items, including expensive electronics such as laptops, cameras, and smartphones. Coverage limits vary between providers, so it's essential to ensure the chosen plan's maximum value covers the total value of your belongings.

Repatriation and Evacuation

Repatriation and evacuation insurance cover the costs related to emergency medical and non-medical evacuation (due to political unrest or natural disasters) back to your home country or the nearest medical facility. This coverage can be vital, especially when working in remote locations or areas with limited access to quality healthcare.

Adventure Sports and Activities

If you participate in adventurous sports and activities during your travels, consider insurance plans that offer sports coverage. These plans may cover potential injuries arising from activities like hiking, scuba diving, skiing, or snowboarding. Always review exclusion clauses to understand any activity-related limitations, as some insurance provides limited or no coverage for specific high-risk sports.

Rental Car Damage and Liability

Digital nomad insurance may provide coverage for any rental car damage or liability incidents. This option helps reimburse expenses related to damages, theft, or third-party liability claims. Rental car coverage can offer peace of mind when exploring foreign countries and relies on a rented vehicle for transportation.

Emergency Assistance

Many digital nomad insurance plans provide access to 24/7 emergency assistance services. These services include access to a network of professionals who can provide guidance, support, and coordination in emergency situations. The assistance can range from emergency medical care to help with lost or stolen travel documents. Having this support available can be invaluable, especially when navigating unexpected challenges in foreign countries.

Pricing and Flexibility

Digital nomad insurance options cater to the need for flexibility, offering various pricing structures and coverage options to accommodate this unique lifestyle. Many insurance companies provide monthly subscriptions, allowing nomads to continually adapt their insurance plan to suit their travel needs.

SafetyWing, for example, has a monthly plan priced at $42. This insurance option specializes in primary health coverage for digital nomads, making it a popular choice for many.

Another insurance provider, World Nomads, offer policies with coverage for periods of up to 180 days. These plans are designed for a digital nomad's adaptable lifestyle and can even be purchased post-departure. They ensure that their clients have adequate coverage throughout their travels.

Flexibility is not only about subscription plans but also about the coverage scope. For instance, World Nomads provides coverage for a wider range of activities compared to other travel insurance companies. This makes them a more favorable option for digital nomads who engage in different activities throughout their journeys.

In summary, digital nomad insurance plans prioritize pricing and flexibility to accommodate the unique needs of their clients. Monthly subscriptions and adaptable coverage options ensure that nomads have the best possible insurance support during their travels.

Dealing with Pre-existing Conditions and Exclusions

When searching for health insurance as a digital nomad, it's essential to understand how pre-existing conditions and exclusions may affect your coverage options. A pre-existing condition is a medical issue that you've previously experienced or been diagnosed with before your insurance policy comes into effect. These can include chronic illnesses, mental health disorders, or past injuries.

Insurance companies often have specific rules and clauses regarding pre-existing conditions. In some cases, they may exclude coverage for these conditions entirely, while in other instances, they could cover treatment for them after a specified waiting period. It's crucial to read your insurance policy carefully to determine how it handles pre-existing conditions.

Exclusions are another important factor to consider. These are specific situations, events, or conditions that the insurance company will not cover. One common exclusion found in many policies is related to war. If you're traveling to or reside in an area affected by armed conflict, you may not have coverage for any injuries or illnesses resulting from such events.

Another exclusion that has emerged in recent times is the pandemic exclusion, which aims to limit the insurer's liability during a widespread health crisis, such as COVID-19. This exclusion means that the policy might not cover expenses related to testing, treatment, or hospitalization for the specific pandemic-caused illness. However, this may vary between insurance providers and policies, so always check the policy details carefully.

Mental health disorders can also be subject to exclusions or limitations within an insurance policy. Some providers exclude mental health conditions, while others offer limited coverage or require a separate policy to handle such issues. If you have a history of mental health problems or want to ensure that you're protected in case of future concerns, pay close attention to how your potential insurance policy handles this type of condition.

In conclusion, when selecting a health insurance policy as a digital nomad, be mindful of how the policy handles pre-existing conditions and its exclusions. Always read the fine print and understand the specific details of your coverage. This will help ensure that you have the protection you need, in case of any health challenges you may face while living and traveling abroad.

Coverage for Remote Workers and Long-Term Travelers

Insurance for digital nomads is essential since they often travel for extended periods and require coverage tailored to their unique needs. This includes health insurance, as it may not be provided by their home country when they work remotely and travel internationally. Additionally, remote workers and long-term travelers may participate in adventurous activities, which makes adequate insurance even more critical.

One popular option for remote workers and long-term travelers is SafetyWing, offering a monthly plan specifically designed for digital nomads. They provide primary health insurance for those who no longer have coverage in their home country. As a travel medical insurance, it caters to digital nomads with affordable prices for long-term travel, the ability to purchase a policy even after starting the journey, and includes Covid-19 coverage.

Digital nomads often travel with expensive equipment, such as laptops and cameras. In this case, it's crucial to choose an insurance policy that covers their belongings. Many travel insurance companies offer protection for personal belongings and electronic devices, ensuring that remote workers can focus on their tasks without worrying about equipment replacement costs.

Travel insurance for digital nomads can also cover various scenarios that might occur while traveling. Depending on the plan's specifics, it can offer protection against delayed or canceled flights, passport theft, and medical emergencies. By selecting the right insurance plan, remote workers and long-term travelers can ensure they have a safety net in place, no matter where their journey may take them.

Overall, remote workers and long-term travelers must thoroughly research different insurance plans and choose the one that best fits their lifestyle and specific needs. By doing so, they can enjoy the perks of working remotely and exploring the world while feeling confident and secure, knowing that they are adequately covered in case of unforeseen circumstances.

Choosing the Best Insurance for Your Needs

Selecting the right insurance plan for digital nomads can be a challenging task. To make an informed decision, it's essential to consider your unique requirements and evaluate various policy features before making a choice. In this section, we will explore some of the most reputable insurance options available for digital nomads.

One popular choice among digital nomads is World Nomads. Known for its flexibility and comprehensive coverage, World Nomads caters to travelers and digital nomads who require coverage for adventure activities and electronics. This makes it an excellent option for individuals who plan on participating in outdoor activities or extreme sports during their travels.

Another option, SafetyWing, provides travel health insurance specifically designed for digital nomads. With its affordable subscription model and global coverage, SafetyWing is a strong contender for those looking for health insurance while working remotely.

Genki Health Insurance is also tailored for digital nomads, offering a range of coverage options and the freedom to choose your preferred medical provider. Its recurring subscription model and wide range of availability make it an appealing option for many remote workers.

Furthermore, digital nomads seeking more comprehensive medical coverage during their travels should consider Integra Global, which offers extensive health insurance plans for long-term travel. This provider is particularly suitable for those prioritizing high-quality healthcare coverage./p>

Lastly, Travelex Insurance is a well-established insurance company with a variety of travel insurance offerings suitable for digital nomads. With customizable plans and a strong reputation, Travelex Insurance can provide peace of mind while working remotely.

When choosing the best insurance for your needs, it's important to weigh each option carefully, keeping in mind factors such as coverage, price, and flexibility. By taking the time to research and compare different providers, digital nomads can make a confident, knowledgeable decision and ensure they are adequately protected while pursuing their remote work lifestyle.

Frequently Asked Questions

What are the best insurance options for digital nomads?

There are various insurance options available for digital nomads, and the best choice depends on individual needs and preferences. Some popular options include SafetyWing, World Nomads, Insured Nomads, and True Traveller among others.

How does travel insurance differ from health insurance for digital nomads?

Travel insurance protects against unexpected events and emergencies that may occur during a trip, such as trip cancellations, baggage loss, or personal liability. Health insurance, on the other hand, focuses on covering medical expenses and treatments in case of illness or injury during the stay in a foreign country.

Can insurance policies be customized for the needs of digital nomads?

Yes, many insurance companies offer customizable plans to meet the unique requirements of digital nomads. Policyholders can choose coverage options such as medical treatments, adventure sports, electronics protection, and more to tailor their coverage according to their lifestyle and individual needs.

Are worldwide coverage plans suitable for digital nomads?

Worldwide coverage plans can be suitable for digital nomads as they provide comprehensive protection during their travels across different countries. However, the specific terms and inclusions of each plan vary and it is essential to carefully review the policy details to ensure that it aligns with one's lifestyle and travel plans.

How do digital nomads handle international insurance claims?

Digital nomads can handle international insurance claims by contacting their insurance provider and following the claim process. Most companies have customer support available 24/7 and offer online claim filing to make the process easier. It is essential to keep all relevant documents, receipts, and evidence to support the claim and expedite the process.

What factors should be considered when choosing insurance for digital nomads?

When selecting insurance for digital nomads, consider factors such as coverage limits, duration of coverage, inclusions and exclusions, travel destinations, personal health conditions, and lifestyle requirements. Also, take into account the financial strength and reputation of the insurance company, customer service, and the ease of handling claims in foreign countries.

Related Articles

Enjoy a Truly Unique CAMP

Experience With Fellow Travelers

SatoriCamp will match you next vacation with like-minded travelers from around the world.

Find your Camp